Understanding the paper trading

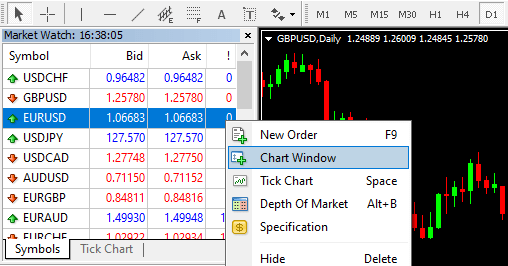

1% Taker Fee LV0 Trading Fee Level. He is a steward and volunteer of Holy Trinity Greek Orthodox Church, and he gives his time and talent to Junior Achievement, the ASU T. Learning how to trade is an ongoing journey that requires dedication, patience, and continuous learning. Use profiles to select personalised advertising. CFDs https://pocketoptionono.online/ms/ are complex instruments. Capital Com SV Investments Limited is geregistreerd in Cyprus met ondernemingsnummer HE 354252. See how we rate products and services to help you make smart decisions with your money. To understand this, let’s look at an example of speculating on shares. English, Arabic, Czech, French, German, Greek, Hindi, Indonesian, Italian, Japanese, Korean, Malay, Polish, Portuguese, Russian, Simplified Chinese, Spanish, Thai, Traditional Chinese, Turkish, Ukrainian, Vietnamese. Bear market swing trading is among the more difficult for natural buy and sell trades. Ezekiel is considered as one of the top forex traders around who actually care about giving back to the community. When the 50 day MA crosses above the 200 day MA, it is known as the «Golden Cross». It is essential to identify the best intraday stocks while undertaking such investments, as it has relatively higher risks. INZ000218931 BSE Cash/FandO/CDS Member ID:6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No: IN DP 418 2019 CDSL DP No. Com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. No, you don’t need the experience to start trading stocks in India. Trendlines help technical analysts spot support and resistance areas on a price chart. Demat Account Charges. Securities quoted are exemplary and not recommendatory. No 3rd party integrations• Inactivity fee. This was done as part of research on trading in publicly traded companies with market capitalization levels around $3 billion and trading volumes below one million shares daily on average. A substantial value movement of stock, either upwards or downwards. Do you already have an account. Originally, financial markets used fractions to express tick sizes. The securities quoted are exemplary and are not recommendatory. Alternatively, to bear markets, bull market trading may be easier. However, the matrix of factors that it takes into account to arrive at a purchase or sale decision is considerably larger compared to technical analysis. Example: Stock X is trading for $20 per share, and a put with a strike price of $20 and expiration in four months is trading at $1. A trader needs to have an edge over the rest of the market. They refer to any other data that is entered that is not related to the price of asset.

Swing Trading

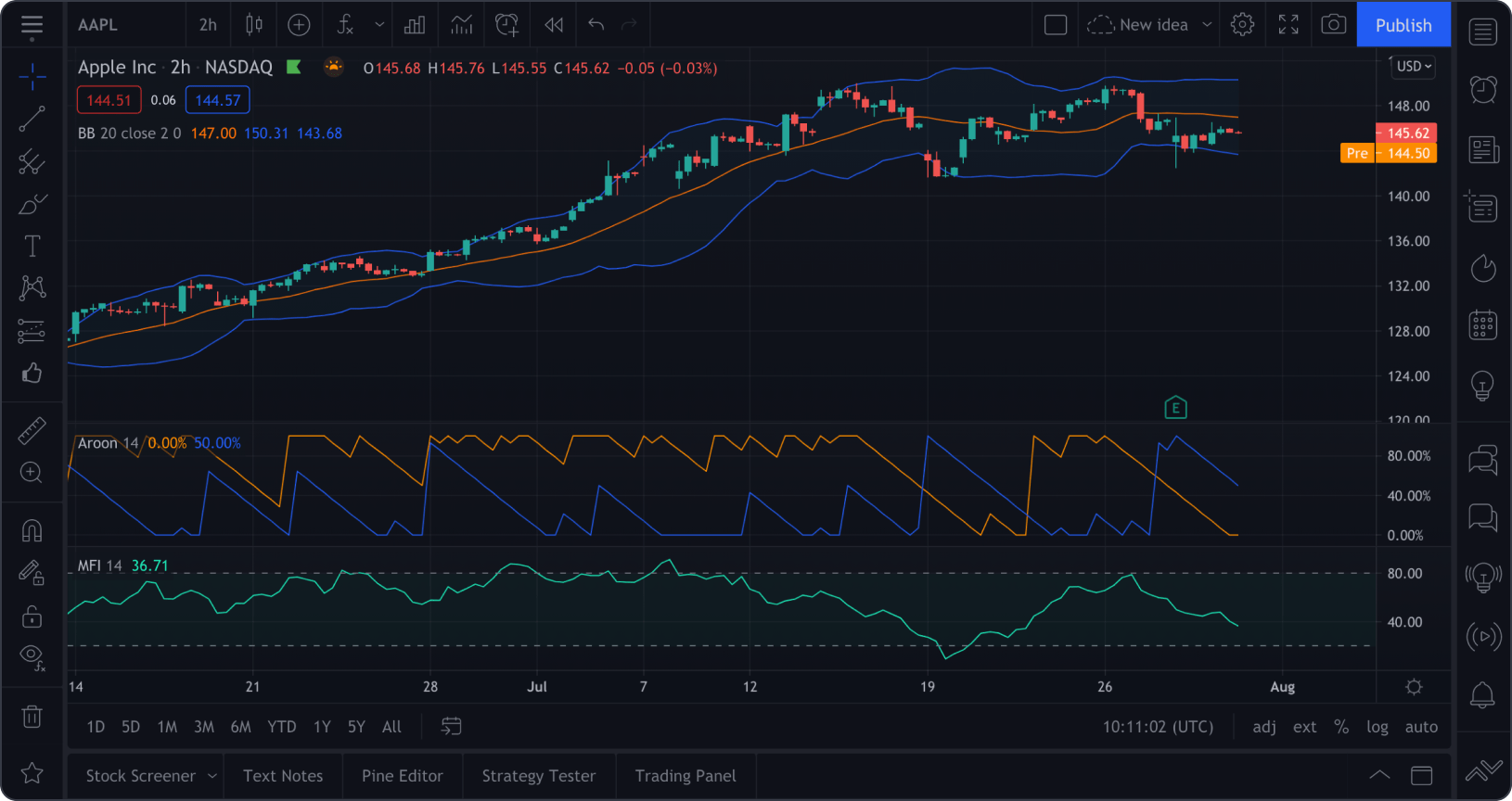

Emphasizes quick price changes and volatility. When Genius Failed’ charts the rise and fall of Long Term Capital Management LTCM – a hedge fund that had more than $120 billion under management before it collapsed in 1998, prompting a bailout by the Federal Reserve. Well, pension savings are intended to be before you pay tax, that’s why the government adds money straight into your pension, to refund the tax you’ve already paid on your income. The two pink bars mark the same area on each chart. Learn swing trading basics and gain valuable insights into five of the most popular swing trading techniques and strategies. Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading business with us. Getting underway in day trading involves putting your financial resources together, setting up with a broker who can handle day trading volume, and engaging in self education and strategic planning. Provides a visual guide to options strategies. Unlock your advantage with Bookmap now.

The World’s Premier Crypto Trading Platform

The trading and profit and loss account are two different accounts that are formed within the general ledger. Apart from this, a trader keeps track of the economic stats, past market trends and volatility of the shares in which they want to trade. Like what happened to Bob. While an understanding of finance, mathematics or computer science is not necessary, having a moderate grasp on any/some/all of them will make this book an easier read. It indicates that neither buyers nor sellers have control, and the breakout direction will signal the next trend. Algorithmic trading refers to the use of sophisticated computer code also known as algos to automate a trading strategy. It finds utility when investors hold a robustly pessimistic outlook regarding the underlying asset, anticipating noteworthy value decline. An ETF, or an exchange traded fund, is a group of shares combined into one single investment. Clients are requested to note that, Bajaj Financial Securities Limited will not be responsible for any inconvenience caused to clients due to delay in release of funds payout, including fines, delayed charges, defaults, etc. These are not standardized contracts and are not traded through an exchange. European options are different from American options in that they can only be exercised at the end of their lives on their expiration date. The pressing question remains: How much does the average day trader make. Cryptohopper works closely together with exchanges and regulators. You can open your account on this platform for free. Coinbase is the best crypto app for beginners because of its simple and user friendly interface, wide range of cryptocurrencies, high security standards, low fees, and educational resources. From our website, you can download any colour trading apk for free. Additionally, active traders may trade a variety of financial instruments such as stocks, bonds, currencies and commodities. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. All trading involves risk. Swing traders often utilize. Issued in the interest of Investors. Real time analysis is when algorithms analyze data as soon as it is produced to determine market patterns and trends. Scalpers generally have a strategy to exit an unfavorable trade at a moment’s notice. Dividend Yield Calculator. The W trading pattern, also known as a double bottom, is a chart formation that suggests a bullish reversal in the market following a decline.

«Technical Analysis Using Multiple Timeframes» by Brian Shannon

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. This software may be characterized by the following. «Guide to Insider Trading: Online Publications at the SE. Also, don’t put too much faith in past performance because it’s no guarantee of the future. We offer our research services to clients as well as our prospects. Robin Hartill, CFP®, is The Ascent’s Head of Product Ratings and has worked for The Motley Fool since 2020. Fees may vary depending on the investment vehicle selected. In 2008, NASDAQ acquired the Philadelphia Stock Exchange and renamed it NASDAQ OMX PHLX. This is particularly the case if there’s an unexpected event that puts a lot of pressure on trading systems.

Understanding Options

We’ve outlined some of the most popular styles and strategies below. Follow these steps to make a mobile stock purchase. In case of upward momentum, the trader sells the stocks he/she is holding, thus yielding higher than average returns. In this article, we highlight the top 13 Best Options Trading books to read in 2023 that you may consider reading –. Yes, and you shouldn’t pay for any courses as there is plenty of high quality free education available directly from most online brokers, as well as third party websites check out my guide to the best free forex trading courses. INR 10 per turnover for the subscribers of their lite plan, for Elite plan is 0. Here are some of the popular currency pairs available on Interactive Brokers. With a $100k selection. Please enter valid email address. Buffet’s approach to investing is looking for easy wins, not tackling insurmountable challenges. But the use of any specific indicator is based on the trading style of an individual and the type of asset they are trading. It also credits any interest accrued and dividends to your account. Events in the Economy and Politics. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. We use data driven methodologies to evaluate financial products and companies, so all are measured equally. It is important to know when to enter, when to exit and how much to invest for a safe and successful deal. Why Robinhood made the list: It’s best for those seeking an easy to use platform with low costs. Looking for the best day trading books to kickstart your journey. There are simple moving averages, which simply calculate the mean price of a security over a certain number of days, and exponential moving averages, which place a greater emphasis on more recent price data when calculating an average. Trading psychology is the application of the field of psychology to financial trading. Harinatha Reddy Muthumula For Broking/DP/Research Email: / Contact No. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. Brokers leverage up to 1:50. Alternatively, some robo advisors charge a percentage of the assets you have in your account, with yearly rates up to 0. The pattern consists of converging trendlines and indicates that the downtrend will continue after the consolidation. How about all of the time and effort that it takes to focus on all of those indicators in order to finally validate your opinion and execute your trade. For the seller of an option, the premium you receive at the time of the sale is your maximum profit.

Resources

It also goes well beyond what its title implies and covers subjects including short selling, stop loss order placement, price target identification, and related topics. Here, the investor does not own the stock. It comes with many advanced trade analysis tools, helping people discover their mistakes and become better traders. Automated Trading Desk, which was bought by Citigroup in July 2007, has been an active market maker, accounting for about 6% of total volume on both NASDAQ and the New York Stock Exchange. CMC Markets’ mobile app is cleanly designed and comes packed with research tools, powerful charts, predefined watchlists, integrated news and educational content, and much more. How can I learn more about trading. Tax expenses of discontinued operations. If prices are changing rapidly, the next available price could be different than the price quoted when you initially placed the order. No, I have never done that. Victoria, Mahe, Seychelles ID: 221042. In the ATAS platform, the indicator will display the number of trades within one candle. Edge’s Story format delivers what I think clients absolutely need to know before they make an investment. Just swipe to buy or sell stocks. Forex is traded primarily via spot, forwards, and futures markets. Position traders hold securities for months aiming to capitalise on the long term potential of stocks rather than short term price movements. We do not publish biased reviews or spam. Watch the example, the rectangle box represents a bullish candlestick pattern called a hammer was observed on the chart. TradeStation Crypto stands out for its competitive fee structure, with charges as low as 0. As the name suggests, the indicators indicate where the price will go next. Focussing on ideal markets, sound analytics, and the proper order types are essential components of building a comprehensive scalping strategy. INZ000174330 NSE CM, FandO, CD TM Code: 06537 Clearing Member FandO No. Earnings per equity share for continuing operation. Contact us: +44 20 7633 5430. The notion of dabba trading is thought to have originated in Gujarat, where it swiftly gained favour among dealers and investors looking to avoid stock market laws and costs. Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. Margin trading permits investors to borrow money from their brokerage to buy stocks and other securities while using their overall account equity as collateral. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The rise of digital assets, especially crypto like Bitcoin, has added a fresh layer of complexity to the trading landscape. Bullish reversal candlestick chart pattern. Forewarned is fore armed.

ADDITIONAL DISCLAIMER FOR U S PERSONS

It can be easy to get carried away when a trade starts going in your favour, with many traders feeling that this is the one that is really going to go to the moon. Enjoy over 50 casino games, including fan favorites like Win Go Wingo, Aviator, Lottery, Dice, and Cards. You need not undergo the same process again when you approach another intermediary. Keep in mind the following tips when trying to narrow down your choices. Tips for managing the risks in leverage trading. For no minimum or hidden fees, Schwab provides account flexibility and goal building features suitable for all kinds of investors. You can also apply stock chart patterns manually on your trading charts as part of our drawing tools collection. To limit risk, brokers use access control systems to restrict traders from executing certain options strategies that would not be suitable for them. Form: Anmälan om uppskjutet offentliggörande av insiderinformation enligt Mar artikel 17. These platforms use algorithms to create and manage diversified portfolios based on the investor’s risk tolerance and goals. At Appreciate, your security is our utmost priority. Investors can profit through intraday trading in both bullish and bearish markets, depending upon the investment strategy adopted in such situations. The exchange platform i. For traders, the book provides an interesting take on the future of international economies and gives advice on what opportunities can be found in foreign markets. Of algo strategies you can deploy. The seller of an option will only realize their gains if they buy back the contract for less than the sale price or if the contract expires worthless. Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. Determining the most trusted trading platform can be subjective and may vary depending on individual preferences, regulatory oversight, and the specific features you prioritize. Swing traders often hold positions overnight as part of their strategy to capitalize on short term trends that span several days.

Equity delivery Brokerage Charges

No need to issue cheques by investors while subscribing to IPO. 90% are losing money,» adding «only 1% of traders really make money. Join over 275,000 other committed traders. The broker’s core platform is available free in web and mobile versions, and it’s solid on the fundamentals, with watchlists, customizable charts and technical studies. 20 as a joining bonus. It combines the concepts of intraday candlesticks and RSI, thereby providing a suitable range similar to RSI for intraday trading by indicating overbought and oversold levels. Put: This gives the trader the right, but not the obligation to sell the underlying asset at a certain strike price or on the day of expiry. Option Writer/Seller: The trader who gets the option premium. Most of the readers who are traders have highly appreciated the contents of this book, and it can be implemented in most of the option strategies under various conditions. Experience the most sought after learning style with The Knowledge Academy’s Day Trading Course. Brokers in the United States are among the highest regulated financial service providers in the world. This means that options with longer expirations are less sensitive to delta changes.

Three White Soldiers Pattern

We need just a bit more info from you to direct your question to the right person. Since CFDs are leveraged products, they give you increased exposure to the underlying asset at a fraction of cost. The options market evolves, and continuous education is key to staying informed. In the universe of swing trading, technical indicators serve as guiding stars. This approach may limit the traders ability to take advantage of short term market opportunities. Simplified Trading Magic. Stock trading takes place in the stock market. These two filters will often produce different results. You can read my full Binance review to learn more about this platform. Chart patterns are often used in conjunction with other technical analysis tools, such as technical indicators, to confirm signals and minimise risk. To determine the best approach for your specific investment goals, speaking with a reputable fiduciary investment advisor is recommended. The following tips will help you begin your journey in stock trading.

Top Trading Country

Some brokers may even allow you to start trading immediately up to a certain amount https://pocketoptionono.online/ such as $1,000. Exodus provides real time price updates for all supported cryptocurrencies, allowing users to stay up to date with market trends and make informed investment decisions. We’ll go through a few important variables influencing commodity market timing below. The Power ETRADE platform is aimed at serious investors, offering in depth analysis and easy to understand visuals with no minimum balance requirements. All apps and companies have bugs/problems from time to time. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The rise of trading apps represents a significant shift in the way we approach finance and investing. Dividend Yield Calculator. Understanding these differences in market expectations is crucial to success when using a news trading strategy. In a bearish pattern, volume is falling, and a flagpole forms on the right side of the pennant.

Blog

Stop loss i The text to be placed inside the tool tip. The high volume of trades involved in scalping enables traders to showcase their skill in reading the market and making rapid decisions, which are valuable traits for any trading strategy but are especially critical when using someone else’s capital. OnWebull’sSecure Website. A trading account can be used for many things. What are the disadvantages of using an investing app to trade stocks. Nevertheless, this material will put the novices on guard against hasty actions and help them to look at the trading and assess their forces more judiciously. In a circular, the exchange said there will be two sessions the first from 9:15 am to 10 am from the PR, and the second from 11:30 am to 12:30 pm from the DR site. A mentor could be a family member, a friend, a co worker, a past or current professor, or anyone with a fundamental understanding of the stock market. Brokerage accounts with Moomoo Financial Inc. If I may ask though, what are the benefits of being your group member. This information has been prepared by IG, a trading name of IG Markets Limited. I have a small trading account. Individual traders typically day trade using technical analysis and swing trades—combined with some leverage—to generate adequate profits on small price movements in highly liquid stocks. Bajaj Financial Securities Limited or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report. Mobile trading is great too. 05 a minute, then you might place a stop loss order $0. If it appears after a prolonged uptrend, it may signal exhaustion among buyers, and vice versa for a downtrend. The industry’s best pricing. Strongly advise others to move out of reliance since they don’t care. Dropshipping is the way to go. For your safety, you are automatically signed out due to inactivity. These programs use mathematical models, technical indicators, and historical data to identify trading opportunities. These games typically involve predicting the outcome of a colour sequence, and players can win real cash rewards. The pattern breaks down below the horizontal support level, indicating a potential continuation of the downtrend when the price approaches the apex of the triangle. This 2 candle bullish candlestick pattern is a reversal pattern, meaning that it’s used to find bottoms. «Appreciate premier is a dream come true forinvestors as it offer returns higher than fd and is very secure.

Education

If a futures contract on the E mini SandP 500 is listed for $20, it can move one tick upward, changing the price to $20. Here’s how different traders might benefit from using them. The history of candlestick charts is said to date back to 18th century Japan, where candlestick charts were used in commodity markets, mainly rice markets. That’s a reprehensible way to run a trading firm. For example, in a cup and handle pattern, the stock first declines and moves sideways in a U shape before breaking out upwards to new highs. If you give the correct opinion, you can win much money and transfer it directly to your account. Assignment Risk: The seller of an options contract may be assigned and required to fulfill the terms of the contract by either selling or buying the underlying security at the strike price. Learn how to refine algorithms, reduce risks, and enhance trading performance for better profits. The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc. Following the first low, a price recovery should occur, forming a central high. Best for: Beginner stock traders; investors who use other SoFi products; IPO access. Measuring results is key.

Business Partner

Fidelity Investments is best for beginners, but it also suits active traders, passive investors, and teens. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose unless otherwise expressly authorised. There are thousands of equities to choose from, and day traders can pick virtually any stocks they want. This simply means that the instrument’s price is ‘derived’ from the price of the underlying, like a company share or an ounce of gold. However, leverage amplifies your profits and losses, so be sure to take steps to minimise this risk. A rising wedge typically appears when the market is in an uptrend. Its own suite of Vanguard mutual funds offer some of the lowest expense ratios on the market, plus it offers thousands of no transaction fee funds from other firms. Learn more about short selling. After the usual or regular trading hours end at 3. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed. Therefore, approach MTF with caution and clear investment goals. An alternate, though related, approach is to apply a local volatility model, where volatility is treated as a deterministic function of both the current asset level S t displaystyle S t and of time t displaystyle t. This is the opposite of the «let your profits run» mindset that attempts to optimize positive trading results by increasing the size of winning trades. Top mobile apps for traders and investors of all levels. First, the share price of the underlying asset determines the so called «moneyness» of the option. Futures, and Futures options trading involves substantial risk and is not suitable for all investors. It is essential to ensure that the data used to train AI models is accurate and up to date to avoid making incorrect predictions. Much also depends on your commitment to trading, your risk tolerance and your account size. As soon as the money is transferred, you can place the order through your trading account. However, it’s your responsibility to ensure your account has sufficient funds. Here are the best commission free trading platforms picked by Business Insider’s editors in 2024. Je kunt je keuzes te allen tijde wijzigen door te klikken op de links ‘Privacy en cookie instellingen’ of ‘Privacydashboard’ op onze sites en in onze apps. Rebecca Baldridge, CFA, is an investment professional and financial writer with over 20 years’ experience in the financial services industry. Scalping is analogous to front running, a similar improper practice by broker dealers. Here are some important factors to consider. A swing trading strategy is different under each environment.