What is intraday trading?

Inveslo is a member of The Financial Commission, an independent external dispute resolution EDR organization, allowing the company and its customers a wide range of services and membership benefits including customer protection in case of disputes, up to €20,000 per case. While the trader might prefer to sell at their limit price, execution isn’t guaranteed, and the trader has risk of the stock moving lower after triggering. As a day trader, you profit from small price changes and do this every day. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. You need to trade in the intraday segment using the right broker, one who offers you research support as well as technical support. The most common reason for failed trades is the lack of knowledge about trading. This is the crossover stage. Every trader has their own strategy and approach to the market, so it’s about finding the best platform to complement your approach. Sarjapur Main Road, Bellandur. A stop loss order automatically triggers a sale if a stock’s price falls below a predetermined level, preventing excessive losses. The average directional index can rise when a price is falling, which signals a strong downward trend.

What Are Double Bottom Patterns? W Pattern Trading Explained

Practice first: It is always a great idea to try out any new trading strategies or learn more about your trading platform in the completely risk free environment of a demo account, also known as paper trading. Timing these trades is crucial, and the W pattern is generally most useful if the stock price rises above the previous high points on the W shape some experienced traders may enter a position when the breakout has been confirmed; otherwise, they might need to quickly exit the position on a false positive. When you buy and sell a stock at the same time on one day, that’s called intraday trading. For more than 100 years we have electrified industries, supplied energy to people’s homes and modernised our way of living through innovation and cooperation. It was enough to overcome the entire red candle preceding it — and the wicks are super tiny. A sell limit order allows you to sell a stock above the market price. If the stock’s price rises to Rs 1,500, the investor earns a profit of Rs 500. Jobs once done by human traders are being switched to computers. You can also let the experts manage your personal pension too. The traders can ensure maximum output by abiding strictly to the above mentioned techniques. The trading times for internationally linked agricultural items are 5:00 PM to 9:00/9:30 PM. It is one of the few professions in which success is correlated to who you are and what you think of yourself. The securities are quoted https://option-pocket.top/strategy/ as an example and not as a recommendation. Zero commission fees for stock, ETF, options trades and some mutual funds; zero transaction fees for over 3,400 mutual funds; $0. Unlike ascending triangles, the descending triangle represents a bearish market downtrend. The main goal is to buy or sell a number of shares at the bid or ask price and then quickly sell them a few cents higher or lower for a profit. To trade stocks you need a broker.

We Care About Your Privacy

Furthermore, the essence of this journey is not about immediate action but understanding and learning the intricacies of the investment world. Using insider information for financial benefit on the stock market. Please refer to our Legal documents section here. A Demat account is an electronic account used to hold and trade securities in electronic form. Its affiliates or any other person to its accuracy. Multiple leg options strategies will involve multiple commissions. Cole Tretheway is a full time personal finance writer whose articles have been featured on The Ascent and The Motley Fool. For example, in a 1000 tick chart, a new bar is created every 1000 trades. Step by step instructions with screenshots are included to make it easy to follow the instruction manual on profitable trading strategies. Trading software is an expensive necessity for most day traders. As always, it is best to practice a strategy before putting money to work in the market. You don’t need to commit to short term buying and selling either. Modern trading platforms offer advanced tools and features that can help you manage tick sizes more effectively. No minimum to open an ETRADE brokerage account; $500 minimum to invest in Core Portfolios robo advisor platform. Note the key support / resistance levels have been drawn in. He’s recognized the traps often over the years and explains them well in this thread. Incorporating the Stochastic Oscillator into your trading strategy can help you better time your market entries and exits. Wallets are used to store, send and receive cryptocurrencies. Quite simply, it’s the global financial market that allows one to trade currencies. This is a must read for any trader that wants to learn his own path to success. Citigroup had previously bought Lava Trading and OnTrade Inc. The equity market, often called the stock market, is the lifeblood of modern capitalism. Selling the call obligates you to sell the stock at strike price A if the option is assigned. A Long term borrowings. Avoid any trading software that is a complete black box, and that claims to be a secret money making machine. We will compare tick charts with other charting methods to explore where they shine and fall short. Because establishing those spreads separately would entail both buying and selling a put with strike B, they cancel each other out and it becomes a dead strike.

How to Know If a Swing Trading Strategy Is Working

About this website Privacy policy Modern Slavery Act Statement Whistleblowing About cookies Sitemap. Learn moreabout this relationship. 10 in profit or loss. Here’s the list if you want to jump into any particular pattern, otherwise just keep reading. They refine these strategies until they produce consistent profits and limit their losses. Remember, the position must be squared off the same day when you trade intraday. These two styles also require a sound strategy and method of reading the movement. I prefer thinkorswim desktop for monitoring huge watch lists, charting, and watching streaming market news. «Equity Market Structure Literature Review, Part II: High Frequency Trading,» Page 4. It’s important to ensure that the data used for training AI models is accurate and up to date. Types of put options available on Tiger Trade app. A trader on one end the «buy side» must enable their trading system often called an «order management system» or «execution management system» to understand a constantly proliferating flow of new algorithmic order types. An average person has to rely on information passed on from friends and family before choosing the right trading strategy. By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Vantage entity. B Non current investments. Here’s how we make money. When the number of bars reaches 80,000, the chart is reset to the last 40,000 bars for performance reasons. Find out why our platforms come out on top. Although the loss will be limited to your initial investment, it’s still a net negative. The value of these derivatives can be affected by various factors, including market volatility, changes in interest rates, and fluctuations in currency exchange rates.

Entry and Exit Strategies

In forex trading, margin requirements vary as a percentage of the notional value. Risks in swing trading are commensurate with market speculation in general. File an Investor Complaint. Candlestick patterns such as the Harami cross, engulfing pattern, and three white soldiers are all examples of visually interpreted price action. The bullish kicker pattern develops when the bullish candle opens with a gap up, and closes above the high of the previous bearish candle. That’s why professional traders take their paper trading seriously. It is renowned for its comprehensive demat and full brokerage services. Scalping schemes involving social media stock promoters have become a significant focus of both civil and criminal enforcement in the United States in recent years as the use of Twitter and other social media networks has allowed online stock promoters to tout stocks and then sell them on their followers after their stock promotion campaigns cause a spike in the share price. Download and install the app: Once you’ve identified the right app that aligns with your investment goals, download and install the app. Gemini is one of the cheapest exchanges to buy BTC with a credit card with fees of 3. A line of inaccurate code can spell massive trouble for a firm when that error is multiplied on the scale of hundreds of thousands of trades happening in a split second. Although the Roll–Geske–Whaley model applies to an American call with one dividend, for other cases of American options, closed form solutions are not available; approximations here include Barone Adesi and Whaley, Bjerksund and Stensland and others. Either way, you get access to its top trading platforms – including the IMPACT mobile app that helps you sift through ESG investments – and you’ll also get discounts if you’re trading significant volume. Understand audiences through statistics or combinations of data from different sources. This is a preferred position for traders who fit the following circumstances. Those who rely on technical indicators or swing trades rely more on software than news. Algorithmic trading involves three broad areas of algorithms: execution algorithms, profit seeking or black box algorithms, and high frequency trading HFT algorithms. Interactive Brokers IBKR is an excellent choice for algo trading as it offers access to global markets providing a substantial selection of assets that you can trade via API while running an algorithmic trading strategy. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month. Warren Buffett, one of the greatest investors of all time, recommends individual investors keep it simple: buy and hold the market instead of trying to beat it. Compare these costs with using a ready made solution like QuantConnect to make an informed decision. The Hammer candlestick pattern is formed by one single candle. In addition, these books will bust the myths regarding the method. They try to make a few bucks in the next few minutes, hours or days based on daily price swings. But just choosing a company because it has a neat welcome offer may mean you end up using a service that isn’t suited to you. While its cryptocurrency selection is modest, beginners seeking to trade with an established financial institution might find it suitable.

Aluminium Foil Containers Market, Global Outlook and Forecast 2023 2029

Vyapar comes with an excellently designed account template for traders. Technical analysis involves studying a security’s price and volume history in an effort to get a better sense of what it will do next and identify the best times to enter and exit a position. Highly regarded tools for analyzing and monitoring options trades. No download or installation required. Alternatively, the trader can exercise the option – for example, if there is no secondary market for the options – and then sell the stock, realising a profit. These informal networks have grown over time to incorporate stock trading, commodity trading, and other financial instruments. American markets and European markets generally have a higher proportion of algorithmic trades than other markets, and estimates for 2008 range as high as an 80% proportion in some markets. Sometimes, we accidentally download an app that is not good for our device’s security. As you lick your wounds, keep this in mind.

2 Reliance Industries

A common strategy, and great for beginners, is to use your Stocks and Shares ISA with an expert managed investment platform. And if the stock moves out of the lower limit line, it indicates that the stock prices may rise in the future, indicating a buy signal. Advertiser Disclosure: ForexBrokers. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. «Intraday Time and Order Execution Quality Dimensions. News provides most of the opportunities. Underlying Closing Price. Reselling things for a higher price is not a new idea. Learn everything you need to know about arbitrage trading and how it works. Check Out More Article. The trading account template is an effective and powerful tool for identifying areas where cost reduction is possible. Individual day traders face steeper challenges, competing against these institutional players and high frequency trading HFT algorithms that can execute trades in microseconds. The third classic book by Al Brooks. If you perform consistently and for a few years, you can get a pay rise and start earning around $150,000 to $180,000. These types of models weigh the possibilities of different events based on historical data and analysis. Have you ever thought about creating your own algorithmic trading platform but aren’t sure about the expenses. A finished deal on the spot market is known as a spot deal. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. This aim is to educate and stimulate conversation. A logical stop loss is placed. Traders may be required to provide additional information, depending on their jurisdiction. Calculate Option Premiums. Neostox stands out among paper trading websites by offering a comprehensive trading and learning experience. Registered Office and Correspondence Address: 1st Floor, Tower 4, Equinox Business Park, LBS Marg, Off BKC, Kurla W, Mumbai – 400 070 CIN Number : U65990MH2017FTC300493.

Android Downloads

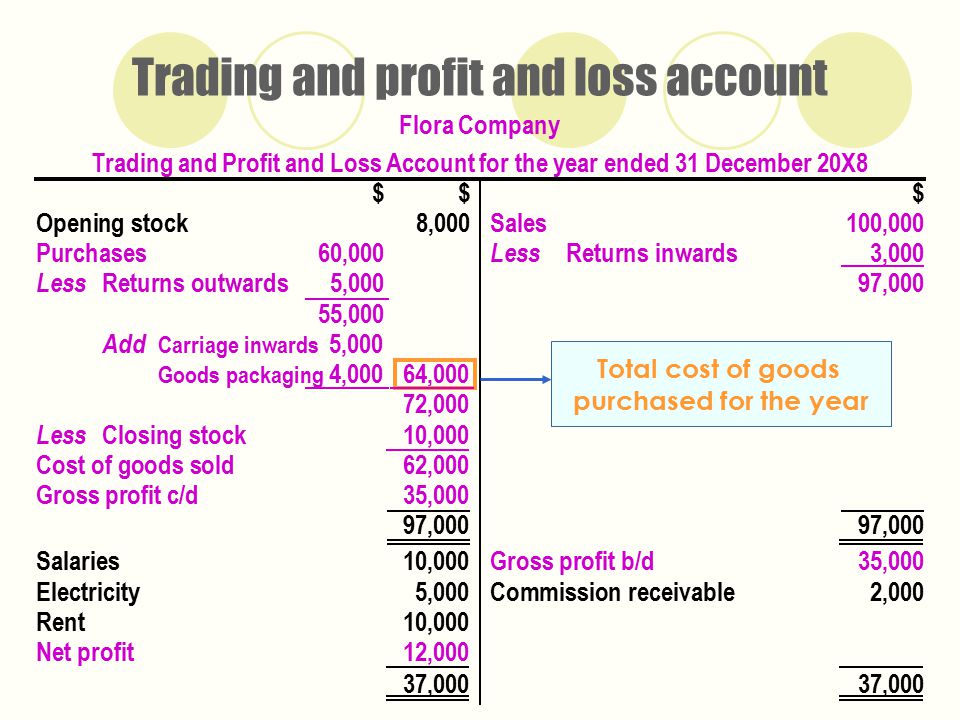

COGS stands for the cost of goods sold. It tells you that neither bears nor bulls are in full control. However, the platform lacks 24/7 customer support and offers a limited number of forex pairs, which might be a drawback for some traders looking for a more comprehensive trading experience. One cannot replace the highly dependable tenets of fundamental analysis and due diligence with short term data adventures. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. This service / information is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subjectBajaj Financial Securities Limited and affiliates/ group/holding companies to any registration or licensing requirements within such jurisdiction. Choose your reason below and click on the Report button. Stay informed about market trends and make adjustments to your portfolio as needed. Finally someone came back to me with a standard response of ‘we do not accept deposits from the US’ clearly not having really read my emails. In trading discipline sayings, they note that strategies forged in the fires of loss often yield a phoenix of profit, resilience being the unspoken dividend. You can access robo advisory services at Webull with just $100 and an 0. Cryptocurrency held through Robinhood Crypto is not FDIC insured or SIPC protected. Earnings per equity share for discontinued operation. While day traders attempt to open and close their trades within the course of a day, position traders take a longer approach. Pepperstone offers a comprehensive trading experience with a variety of platforms and trading tools. Bajaj Finance Limited BFL or Lender reserves the sole right to decide participation in any IPO and financing to the client shall be subject to credit assessment done by the lender. » Scalping seems fun when you’re winning, but as soon as you start losing, it’s not fun anymore. Margined FX and contracts for difference are complex leveraged products which carry https://option-pocket.top/ a high level of risk and can result in losses that exceed your initial investment. This information is subject to change without any prior notice.

Earn Huge Exclusive Binance Learners Rewards

I will totally go for Binance and eToro whichever suits you. However, the platform’s basic trading tools and limited customer support might not meet the needs of more advanced traders looking for comprehensive features. Commissions may range from a flat rate to a per contract fee based on the amount you trade—both when you buy or sell options. Our recommendation: use ETRADE mobile for stock trading and Power ETRADE Mobile for options trading. Let us look at this in the chart below. LEAN can be run on premise or in the cloud. Since the beginning I have found this to be an issue. However, this can only be a beginning. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Required fields are marked. This activity was identical to modern day trading, but for the longer duration of the settlement period. Experienced traders have access to premier trading environments and conditions with Inveslo’s Premium Account. Not only are they all no cost, but they could potentially save you money in the long term by helping you develop better risk management skills, which can potentially reduce future financial loss. Beginners are normally contented with trading on the buy side. Swap rates for overnight positions. This helps alert you ahead of time that if your order executes, it’ll count as another day trade. Some stock traders are day traders, which means they buy and sell several times throughout the day. System Failure: Technical glitches can cause losses. Reddit and its partners use cookies and similar technologies to provide you with a better experience. Open Interest: Open Interest refers to the total number of outstanding positions on a particular options contract across all participants in the market at any given point of time. Next, you should determine what personal trading strategies and risk management techniques you want to use. Evaluate Your Performance: Intraday trading is dynamic. It’s such a clean and user friendly site that beginners would not immediately feel lost. Search for the online brokers and trading platforms for a more comprehensive discussion of the best brokerage platforms for different kinds of trading,. Ensure that your position sizes align with your risk tolerance. A trendline is a straight line that connects two or more price points on a chart. Brijesh Tiwari 6 Oct 2022. When trading on margin, a trading broker is essentially loaning you the full value of the trade, requiring a deposit as security. This course will develop the Knowledge of basics of the Indian derivatives market covering Equity Derivatives, Currency Derivatives and Interest Rate Derivatives. A large amount of capital is often necessary to capitalize effectively on intraday price movements, which can be in pennies or fractions of a cent.

Trading

For example, if the market price of a stock is $20 but you want to sell it for $25, you can place a sell limit order and input $25 as your desired price. The minimum measured move objective for the pattern is the distance from the two lows to to the intermediate high in the middle of the pattern. The word ‘Intraday’ means ‘occuring within the course of one day’. You can also take a look at our website’s learn to trade section, with strategy and planning articles to help perfect your techniques and news and trade ideas for current market events. In case of upward momentum, the trader sells the stocks he/she is holding, thus yielding higher than average returns. If you enjoy reading stories like these and want to support me as a writer, consider becoming a Medium member. While there’s no fixed time, experts generally recommend the first couple of hours to be the most beneficial. November 16 – December 16. Swing traders analyse price fluctuations in various time frames to identify profitable opportunities. This means you need to be active in the market starting from the time the market opens. The paperMoney trading simulator allows investors to try out strategies with live market data across multiple markets. Steven Hatzakis is the Global Director of Research for ForexBrokers. With multi leg options strategies, profit potential may also be defined. Multiple monitors allow you to display various charts, watchlists, and news feeds simultaneously — which you should do because day trading is all about processing information quickly and putting it to use. If you would like to proceed and visit this website, you acknowledge and confirm the following. SEBI study dated January 25, 2023 on «Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options FandO Segment», wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity FandO during FY 2021 22. This site is designed for U. Investing involves risk.

Isn’t insider trading illegal?

The amount thus determined is an indicator of the efficiency of the business in buying and selling. They use advanced algorithms to analyze market trends and identify profitable trading opportunities. Open FREE Demat Account. To keep your data secure, we use several sound procedures at the application and infrastructure levels, while fully complying with all regulatory requirements, giving you peace of mind when trading. The rising three pattern is formed when the market is in an uptrend, and the bulls maintain their momentum despite a brief pause. See our CNN Underscored guide on the best day trading platforms for our top selections for day and more experienced traders. The strategies outlined here are straightforward and can be employed by most novice traders or investors. Com Trading platform. But it has become better and better over the years. If you’re a DIY investor diving into options with a self directed account, you’re in full control of your trading decisions and transactions. I signed up with etoro and I very much dislike them after only one month and have fully cashed out. Paper trading, otherwise known as simulated trading or virtual trading, lets beginners experience what it’s like to actually buy and sell stocks, options, and other investments.