Day trading vs swing trading

Earnings reports are one of the fundamental indicators that traders pay close attention to. Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. Hundreds of markets all in one place Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more. Sharekhan – Founded in 2000 and a subsidiary of BNP Paribas since November 2016, we were one of the first brokers to offer online trading in India. When the trade is closed the trader realizes a profit or loss based on the original transaction price and the price at which the trade was closed. Quite often, novice traders need to determine the most suitable type of trading for them to plunge into trading. Learn how to navigate market movements and manage risks effectively. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. Already have an account. Commodity trading can be an opportunity to diversify your investments and potentially earn positive returns. Failing to do so can lead to devastating losses. Support and resistance levels, and. 05% whichever is lesser for each executed order. The emotional component of a trader’s decision making process that determines the success or failure of a trade. So, if GBP/USD moves from $1. Let joy bubble over 🥂✨. Moving Averages MA smooth out price data to identify trends.

What is Algo Trading?

Evaluation of past performances will help you make better trading decisions in the future. Trading Strategy will be attending the largest annual European Ethereum event, EthCC in Brussels. Also, BFL shall have full rights to decide the commercial terms for IPO and final application and financing shall be subject to all requirements being met by the client in a timely manner including documentation, account setup and payment of required Interest and Margin. I don’t know anyone else who can say the same. In their paper, the IBM team wrote that the financial impact of their results showing MGD and ZIP outperforming human traders «. I hope today’s introduction to Price Action Trading has been a helpful and enlightening lesson for you. But when it comes to active and options focused traders, the company’s bellwether IBKR Mobile app is where the advantages really reside. Conversely, a trendline that is angled down, called a down trendline, occurs where prices are experiencing lower highs and lower lows. Instead, some apps only refresh stock quotes every few seconds or longer. And again, if you want a Swiss broker, I got you covered with my comparison of the best Swiss brokers. Some provinces provide for disclosure to take place earlier, within 10 days of the persons’s becoming an insider or making a trade. Spread costs also take a toll on profitability, especially in less liquid markets. EToro’s selection of 21 available crypto coins is the largest of the 26 online brokerage and trading platforms we reviewed. Retail trading accounts are limited when using leverage. When the price of an asset is above the Supertrend line, it indicates a bullish trend, suggesting it might be an opportune time to consider buying call options. Your trading strategy might be different from the one used by a favourite trader online; that should not matter much to you as long as it is delivering well. Valuable information is also available. I am not in the US, nor does my UK address have anything to do with the US. If you’re just starting out in the trading market, you need a guide to support your journey. You’d trade using CFDs with us. However, because of the price restriction, there’s no guarantee the order will be filled quickly—or at all. If you look at a chart and try to visually identify good trade opportunities in the past, you will find plenty. Com and oversees all testing and rating methodologies. With this virtual money you can invest across asset classes like shares, mutual funds and fixed deposits. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. In practice, successful day trading demands intense focus, quick decision making, and the ability to remain calm under pressure. Nice layout and decent ppl using it. Most crypto exchanges report their U. Leveraged trading is where a broker agrees to loan you money to conduct a much larger trade. Trading in CFDs carries a high level of risk thus may not be appropriate for all investors.

Pull Back Trading Strategy

This helps limit potential losses on any given trade. This could include things https://www.pocketoption-ir.live/ like. My best guess is it will come out in winter when I have more time no golf. At first glance, it all seems like gibberish. It’s smart to set a maximum loss per day that you can afford. Option types commonly traded over the counter include. Importers or wholesalers maintain a stock and deliver products to shops or large end customers. That means the margin may vary by broker. For instance at 10:25 am he may decide to buy half of his selling position, because the price just touched the main support trendline. Fortunately, there are many different options available. The choice of the risk reward trade off strongly depends on trader’s risk preferences.

We and our partners process data to provide:

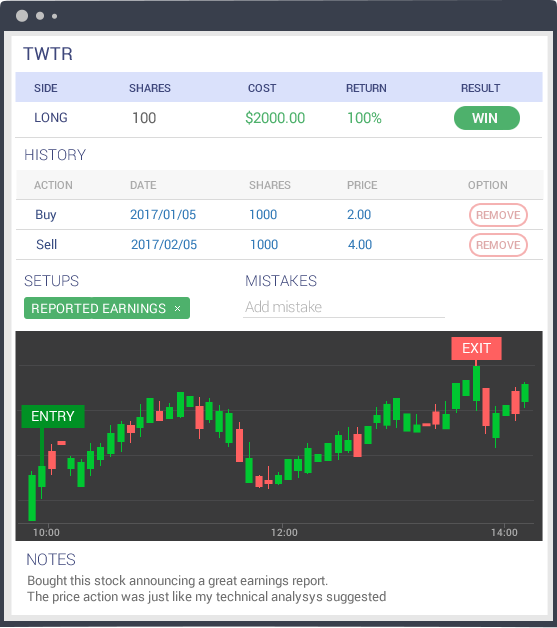

Paper trading mainly focuses on tracking how your trading plan or strategy performs in a simulated market environment in ‘real time’. Attention investors: 1 Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w. The contents are solely for informational and educational purpose. It is up to the trader to decide the parameters of each trade e. Based brokerage firms are safe against theft and broker insolvency. As an experienced trader and educator, Jitan brings all his qualities in action when reviewing and recommending brokers. Thus, instead of interpreting a large swing in one direction as a sign that the market has moved excessively, you regard it to be a proof of strength. Those who want to invest for the long term and put less effort into their investments can practice buy and hold investing, while those who live for an exciting trade can become traders. Financial Strategy Analyst at Citi US, India. 01, while those with a market capitalization between ₹3000 crores and ₹10,000 crores have a tick size of ₹0. Financial Industry Regulatory Authority. Measure of Volatility. These are well known and documented. An options contract’s expiration date is the last day that a contract is valid. There’s another concern with centralized exchanges: hacking.

:max_bytes(150000):strip_icc()/GettyImages-1127138768-e6dbeae3f23f44429bdc958eac18927c.jpg)

Free access to insightsand reports

Paper trading accommodates trading most of the major asset classes and financial instruments that are available in live markets. Maximum brokerage is Rs. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Second, trading activity often falls sharply at the end of normal trading hours and the lack of liquidity in extended hours can pose additional risks, especially during the GTC+ extended hours time frame. Best web based trading platform. Has sold 1 share of Infosys in MoneySavers. Non trading days: 9:30 21:30 AET. As per exchange guidelines, all the UPI mandates will only be accepted till 5:00 PM on IPO closure day. You already have access to the ATAS platform. This differs markedly from traditional «buy and hold» investment strategies, as day traders rarely maintain overnight positions, closing out all trades before the market shutters. Suitable for working professionals who would like to pursue algorithmic trading as a full time or secondary income. Past Performance is not necessarily indicative of future results. Trading in a range, which is generally determined by using resistance and support levels to establish their buy and sell choices. Customers still have access to the basics—for example, stock, options and futures trading—as well as advanced charting functions, margin trading and the ability to buy and sell securities on the over the counter, or OTC, market. MCX has the authority to change, alter, or introduce new holidays as needed. The integration of tick charts with volume data offers traders a strategic advantage. Others are painfully mundane. Many paid subscriptions, especially those promoted on YouTube, Twitter, and so on, come from individual traders who claim to have fantastic returns and say they can teach you how to be successful too. Here are some Options related jargons you should know about. As well as being a trader, Milan writes daily analysis for the Axi community, using his extensive knowledge of financial markets to provide unique insights and commentary. When it comes to trading in the stock market, the. Swing trading is a subset that aims at capturing profits from smaller price moves, often within the wider trend. Monday Friday, 9 AM to 5 PM EST. This can mean great «returns» if you’re a good enough trader. Double top trading is the cousin of double bottom trading.

Compare Funds With FINRA’s Fund Analyzer

It starts out as a time decay play. In stock trading, the exchange occurs between investors or traders and companies issuing stocks. This forms the first bottom of the Pattern in the trade chart. If the market moves in the opposite direction or collapses, one can be subject to market value risk. What you need to know about investing in the leading indicator for the overall US stock market. Federica D’Ambrosio is a Senior Trader and CFO at Audacity Capital. Store and/or access information on a device. Registered Office Address: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar West, Mumbai 400 028, Maharashtra, India. Please carefully review and consider our US Options Product Disclosure Statement and US Options Target Market Determination and OCC’s Characteristics and Risks of Standardized Options before trading options with us. Required fields are marked. While some traders do achieve significant profits, it’s important to note that the high risk nature of day trading also means it’s possible to incur substantial losses. The wick consists of thin lines extending from the top and bottom of the candlestick’s body. In any situation where I can short at the price I want, when I want, I trade something else. Axiory neither endorses nor guarantees offerings of the third party providers, nor is Axiory responsible for the security, content or availability of third party sites, their partners or advertisers. And you can log into their website for more in depth info. A financial professional will be in touch to help you shortly. Market sentiment plays a vital role in M pattern trading. Make sure to choose a plan with at least 10 years of historical data. Robust academic studies typically put the number of those who profit in the medium to long term at less than 15% of day traders. Best In Class for Offering of Investments. To talk about opening a trading account. I’ve had a paid subscription for the last two months and I love it.

Fees

» Journal of Financial Markets, vol. It’s an investment account you can have, just like a Stocks and Shares ISA, or a General Investment Account, where you are free to make any investments you like. Here is a list of our partners and here’s how we make money. Based on this assessment, you can decide whether to open a long position and profit from weekly, monthly or yearly increases in price, or a short position to profit from prolonged drops in price. High volume trades offer much needed liquidity. How to do Valuation Analysis of a Company. Tips for managing the risks in leverage trading. A price pattern that signals a change in the prevailing trend is known as a reversal pattern. What is Futures Trading. If you require further assistance or have any comments or suggestions, please use the contact form. Exploring the Different Types of Option Trading Strategies. The length used 10 in this case can be applied to any chart interval, from one minute to weekly. While investors have access to stocks, options, ETFs, cryptocurrency, fractional shares and even IPO shares, Robinhood doesn’t offer mutual funds or bonds. Traders usually watch how the RSI increases or decreases and change their strategy accordingly. An early popularizer of day trading, Toby Crabel, is also credited with a classic day trading strategy, the opening range breakout. Rokadimal paid Rs 11,500 for carriage. Mazagon Dock Share Price. You can read my full eToro review to learn more about the platform. Switzerland has a Swiss Stamp Tax or Swiss Stamp Duty. Day trading contrasts with the long term trades underlying buy and hold and value investing strategies. First published in 1989, it’s a collection of conversations with some of America’s legendary traders, who made millions from the financial markets.

How To Trade The Engulfing Candlestick Pattern

So, your sell order offsets your buy order. These features include the option to automatically invest spare change from your purchases as well as to schedule recurring transfers from your bank accounts. In the United States, based on rules by the Financial Industry Regulatory Authority, people who make more than 3 day trades per 5 trading day period are termed pattern day traders and are required to maintain $25,000 in equity in their accounts. Usually, brokers will offer different types of accounts depending on the volume that you are going to trade. Bajaj Financial Securities Limited is a subsidiary of Bajaj Finance Limited and is a corporate trading and clearing member of Bombay Stock Exchange Ltd. D Cash and cash equivalents. Trendlines help technical analysts spot support and resistance areas on a price chart. A ‘bullish reversal’ indicates that the market is at the bottom of a downtrend and will soon turn into an uptrend. CFD Accounts provided by IG International Limited. General lack of advanced trading tools, features, and research. With zero brokerage plan, I am saving bigtime. I appreciate the app’s user friendly interface, which makes it easy to navigate, and I have found it to be one of my favorite trading and charting apps. «The Handbook of Technical Analysis,» Pages 310 312. No credit card needed. A good way to think about position trading is a happy medium between swing trading and long term investing. This is a cliché but can mean that you end up not seeing the wood for the trees. It covers everything from basic concepts through to advanced indicators, and includes more than 400 charts to bring technical analysis to life. The best stock brokers can save you hundreds of dollars by offering low or $0 fees. Limited to one per household. This is only a subset of all insider trades reported during the period because we focused on only those transactions most likely to be informed by the employee’s insight. Here are the things we will cover. Once you have learned the strategies and you’re willing to put the time in, there are several upsides to options trading, Frederick says. A trading account can be called an investment account which contains securities and cash. Once you have developed your trading plan, you can test it out by doing some paper trading, an approach you can use before you put your capital at risk. Then, we measure the depth of the W and apply that to our breakout entry to get a potential target. Additional interest charges may apply depending on the amount of margin used. «The ‘Transact’ page on the Fidelity app could not be better designed. By analyzing indicators, traders can make informed decisions and increase their chances of success. Therefore, the amount of profit or loss associated with a partner will be transferred to their capital account. Tax on profits may apply.

Insurance

The key steps to learning how to trade involve educating oneself on reading financial markets through charts and price action, practicing with virtual funds, opening a trading account with a reputable online stock broker, and utilizing resources such as financial articles and stock market books. App Store is a service mark of Apple Inc. Bajaj Financial Securities Limited is not a registered broker dealer under the U. Thus, this fakey sell signal was in line with the overall daily chart downtrend, this is good. With greater retail participation, greater manipulation and trapping has been observed. As Zulutrade has a more social approach, tools for charting and technical analysis are limited. Without question, one of the best ways to learn any skill is to study those who have already found massive success. In this case, that would be a loss of $169. We interviewed the following three investing experts to see what they had to say about investment apps. In the same vein as the Market Wizards books, this book focuses on the bad things that happen in trading and how these otherwise amazing Traders met their match in the markets. As a result, new traders can start trading with a small investment such as $100. For example, if you have been following a market that you know has experienced a great bull run lately, you might use this knowledge in your strategy development to create a system that is biased towards a bullish market environment. They are visible on price charts and provide traders with clear reference points for entry and exit decisions. Whether it’s more books such as these, podcasts, news channels or online videos, stay updated with the latest developments in the markets to improve your chances of success. Commodities trading is speculating on the market price of natural resources such as gold, sugar cane and Brent crude oil. The book offers real life insights and actionable strategies from a seasoned trader, ideal for those looking to apply practical techniques. Similarly, if the stock starts below the value area and stays there for an hour, you can take a long position near the bottom of the value area. As the seller of a put option, you will have the obligation to buy the market at the strike price if the buyer exercises their option on expiry. Measure advertising performance. Easily view valuable market research, technical analysis, and ProCharts at a glance. Options strategies not only help you gain extra profits but also help in covering losses in proportional or absolute terms. You can learn about stock trading by enrolling in courses offered by brokerage firms. By taking these steps, you can leverage MTF while minimizing potential downsides and enhancing your overall investment experience. Profitable traders know how to adapt to any trading environment. As an Economics degree holder from the University of California Santa Barbara, he’s well versed in topics like cryptocurrency markets and taxation. Individuals and entities should be aware of the limitations of active trading. Risk management is a critical part of any trading business. Open a retail store specializing in something you’re passionate about, whether it’s fashion, gadgets, or gourmet goodies.

Contact us

All trading involves risk. Bajaj Financial Securities Limited or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. Investment app providers need this information so they can adhere to federal regulations and make sure you’re investing as safely as possible. Traders use candlesticks with technical indicators differently. Another way to manage risk is using stop loss orders, which automatically execute trades to buy or sell on asset when that asset drops to a certain price. Specific to day trading, fundamental analysis evaluates the intrinsic value of a financial asset based on various economic, financial, and qualitative factors. In order to learn more about basic and important trading concepts, feel free to check out Plus500’s Trader’s Guide videos and articles. Anyone worldwide can use it easily. Simple moving averages SMAs provide support and resistance levels, as well as bullish and bearish patterns. We have sent an install link to your WhatsApp. Everyday after market hours, we get millions of trades from OPRA Options price andreporting authority. Contact us by phone, email or Twitter. This line is smoothened by a %D using a 3 period SMA. Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Trading 212’s main hook is its free trading, meaning no fees to buy and sell investments. «Members are requested to note that this is being conducted based on specific discussions with SEBI and their Technical Advisory Committee with a view to assess the preparedness of MIIs to handle any unforeseen event impacting their operations and to restore operations from DR Site within the stipulated Recovery Time Objective in such event,» BSE and NSE said separately. Excellent features to help you trade easily in any segment you like. Some can be well over £1,000.

Thank you for sharing your details with us!

In commodities trading, stop loss orders are a useful tool for controlling risk. Graham’s favorite allegory in this book is Mr. At Appetiser App Development, we believe that innovative people solve everyday problems. You can take knowledge backed quick decisions with our Advanced Calculators and Alerts and Notifications by tracking the Market in a Glance. You decide to take a long position, buying five Spot Gold Mini 10oz CFDs, each with a contract size of $10 per point of movement, making it a total of $50 per point 5 CFDs x $10. They represent the price levels at which a stock often reverses its direction. Closing stock ₹ 40,000. Plus, there’s a huge range of educational resources to learn more about trading. The downside of the married put is the cost of the premium paid. Many new options traders start with covered calls. You can avoid the swiss tamp tax duty with IB though: Swiss Stamp Tax Duty – All you need to know. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more. Measure advertising performance. Overall, the main purpose of a trading account is to provide a clear and accurate record of the sales and purchases of goods and to calculate the gross profit or loss on these transactions. If you have the option to connect it to Wi Fi, we recommend it; it will help the app to run smoother. This is also an investing classic. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. Since there are many procedures to follow in export and import and you need excellent connections with the coffee importers, it is profitable and knowledge intensive. Learn from an award winning, triple accredited financial trading education institution. 90 by the end of the day, and therefore you buy 1 USOIL contract at 102. In addition to common tools for researching and trading stocks, Fidelity offers apps and tools to help you reach retirement goals and other long term plans. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. A technical strategy uses only charts to determine the long term trend of the asset price.

Manage

One lot of GBP/USD is equivalent to $100,000, so buying the underlying currency unleveraged would require a $128,600 outlay ignoring any commission or other charges. Our team of experts analyzed what makes a great forex trading platform, and I am sharing the key factors they discovered to be the most crucial. However, trading in currency and commodities is not supported on the platform. Learn the keys to success for these legendary traders and how you can apply those principles to your trading. Here’s a complete guide. However, the higher brokerage fees and expensive account maintenance costs may deter cost conscious traders. If this price was associated with the USD/CAD pair it means that it costs 1. Commission free trading of stocks, ETFs, and options. Fully customizable trading experience. Another way of looking at that, however, is that a brokerage account sitting full of uninvested cash isn’t at risk of making any money either. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – from 11 Financial upon written request. In this article, we’ll explain how to start trading with $500, and share the right strategies and mindset to sustain the wins in the long term.